Business news for the Gazelle Economies of Sub Saharan Africa. The Gazelle Economies are the Emerging New Frontier economies of Black Africa. The Future is Emerging

Monday 14 December 2015

Nurturing Talent Is Hard in Africa

Sunday 13 December 2015

Africa: Business Class - China and Africa - the Lessons From the East

Monday 7 December 2015

Naira weakens, sells at N250 to dollar

The black market, or parallel rate fell to 253 per dollar from 246 on Thursday and 222 last month, according to Aminu Gwadabe, president of the Lagos-based Association of Bureau de Change Operators of Nigeria.

That’s 22 percent weaker than the official rate used in the interbank market, which was 198.50 in Lagos. “The Central Bank will say they don’t care about the parallel market, but investors are looking,” Gwadabe said by phone. “Why will they bring in their money at 197 or 198 when the parallel rate is 250?”

The official rate in Africa’s largest economy has been all but fixed at 198-199 per dollar since March after Central bank Governor Godwin Emefiele restricted banks’ ability to buy dollars. In June, he stopped importers of about 40 items, including wheelbarrows and glass, from obtaining foreign-exchange.

Foreign investors have criticised Nigeria’s stance and sold bonds and stocks this year on expectation of a devaluation, which would cause losses on their holdings in foreign-currency terms.

The naira’s fall in the black market comes as the Central Bank restricts dollar supplies further to save its foreign reserves, which fell below $30 billion for the first time in four months on November 30. About 1,200 money changers, or 60 percent of the total in Nigeria, were denied their weekly allocation of $30,000 from the Central Bank on Wednesday, according to Gwadabe.

His association has requested a “crucial” meeting with the Abuja-based regulator on December 8 to address the issue, he said. The phone of Ibrahim Mu’azu, a spokesman for the Central Bank, was turned off and he didn’t immediately respond to a text message requesting comment.

“If they continue what they’re doing this week, next week will be worse,” Gwadabe said

Source: http://thenationonlineng.net/naira-weakens-sells-at-n250-to-dollar/

Tuesday 1 December 2015

'It's possible for regular people to build pan- Africa business'

co-founders of Cellulant, have taken the company from a payments technology

start-up to a pan-African corporation connecting more than 40 million customers to mobile payment solutions. They were recently in Cape

Town where they jointly gave the keynote address at the third annual MasterCard

Foundation symposium on Financial Inclusion. Our

correspondent in Cape Town Mwangi Githahu caught up

with the two to discuss digital

commerce among other subjects.

|

| Bolaji Akinboro |

|

| Ken Njoroge |

Many people hear the words ‘digital

commerce’ and think M-Pesa. There must be more to it than that. Simply explain

what digital commerce is?

Bolaji: The

simplest definition really goes beyond M-Pesa. Because

M-Pesa originally was kind of into money transfer, [in fact] more peer-to-peer,

then later it migrated to peer-to-business (small businesses) and I believe now

it is moving into its third evolution, which is peer-to-really big businesses.

So really the idea

of digital commerce is to create an environment in which consumers can benefit

from getting what they want, when they want it and how they to pay for it. On

the other hand, businesses are empowered to connect to their consumers with

ease. Within that space they can do both virtual

transactions and transactions that translate into physical goods.

In today’s world there are things that

are purely virtual, like if you are buying airtime now, it’s a purely virtual

transaction, there is nothing physical involved with

it. But at the same time, if I wanted a taxi cab and I wanted it to come now, I

could pay for it digitally like with Uber but still get the physical taxi that

comes to fetch me.

Ken: I

think that basically gives the definition. I mean M-Pesa was just the beginning of this digital revolution so it is

not an end in itself but the starting point, a piece of service out of maybe

another seven or so that make up the broad world of digital commerce.

So do you think that this technology is what will finally give Africa an advantage over the wealthier

nations of the world?

Ken: I think so because if you look at digital payments and

that sort of thing and you look at the sort of speed that this is happening –

think about it. Fifteen or so years ago most of us

didn’t have mobile phones. But within that period of time, if you look across

Africa 500 million people have come onto the mobile phone network so they are

visible. As a result of that [sort of progress] all these narratives around Africa rising just popped up because these

numbers just leapt out of the woodwork.

What digital

does is to create efficiency in payments — because transactions are cheaper. It creates efficiency in

reaching markets and enables easy delivery of services. And not just markets, even the basic stuff that we struggle with on this

continent — getting food to everybody across the pyramid, getting water

to everyone, getting power to everyone, getting health and education to

everyone. Digital payments are completely going to revolutionise the speed, the scale and the cost of getting services to the

people and that will be transformational for the continent.

So because of

that process we get to leapfrog a lot of other stuff. We [now] don’t need to go

through the learning curve with technology. Just like

it was literally within the blink [of an eye] before 500 million

people had phones. We didn’t

need to dig up [the pavements] and lay cables all over the place. [Snaps

fingers] it just happened like that.

Can you speak of any future strategies

for the company or have one-stop payments and digital commercial services

reached their peak?

Ken: This is just the beginning.

Bolaji: We haven’t even started scratching the surface. Our own

strategic view of the future is very different from other

people. We feel that fundamentally there is what we call the bread and butter, which is

really bringing merchants and banks together within the eco-system [we are

building] — that’s really the bread and butter part. But beyond that

it’s really the market place because what we call the ‘Cellulant Mall’ which is so much more sophisticated than paper. If you

come into that mall you will find that we’ll connect everyone to everything

every day.

Give me a practical example of that. How does it work in an African context?

Bolaji: Let’s take what we call the e-wallet now. We are

connecting everyone in agriculture in

Nigeria to everyone — we are

connecting more than 14.5 million farmers to about 2,500 agro-dealers to about 115

seed companies to about 75 fertiliser suppliers, to

about three insurance companies.

So if you are

looking for someone in your neighbourhood to sell you seeds you can just get on

your phone and get in touch with whomever you need to deal with to get whatever

it is you need to get done.

So while there is the sophisticated part of our business, we

are fundamentally a people’s company.

What are the challenges and opportunities for Cellulant in

the next couple of years?

Ken: Our business is growing of course so I’ll start by looking

at that question in terms of opportunities, as that’s what drives us.

So there are

problems in the market that benefit from what we do and the experience and

expertise we’ve built. People don’t have water. The sort of problems that we

solved in Nigeria and that we are solving in other

countries still exist —

those problems affect not just agriculture, they affect power, and they affect

everything.

What’s nice

about digital payments and the services we offer in Africa is that it is not one of those things that is [referred to as] “good to do”, they are just a basic part of

the necessity of living.

Basically if

we didn’t do what we did in Nigeria, people would have starved to death. If we

don’t continue doing these things people don’t get water etc. So these services that our consumers take up are not novelties but basics

that consumers can’t do without. They are essential services not “good to do”

but necessary.

Digital

payments allow essential stuff to get to the consumers. So as long as that

continues to be true and it will continue to be true

for a while, it is basically a tremendous opportunity for us to build a great

business.

So we are not

an NGO, we are a profit business and we believe there are profits to be made in

that business of solving problems.

As for challenges, I look at them as internal and external. So

external challenges are fundamentally competition, there is also the regulatory

framework — because we are operating on the cutting edge of payments

and services, we have to continue to educate stakeholders,

regulators, mobile operators etc about some of the things we do.

That takes

time, effort and sometimes slows things down but it is a very necessary part of

things.

The other

challenge is obviously the competitive environment. As it becomes clear that there are opportunities to build billions of dollars in

terms of businesses, it attracts competitors. So we find ourselves competing

with companies like us that operate only in specific countries, others like

us who operate across multiple countries and sooner

or later some of the larger global businesses will get into the fray. So

competition is a big challenge that we need to keep dealing with and we deal

with it by being very agile and very nimble. Also, most

importantly, we really have experienced and

understand these problems.

On the

internal side, I think the biggest challenge we have is the question of

how we build talent and find talent to match the growth of the business. I

think today that is our single most important challenge and we are spending a lot of time figuring it out.

Think about

it. Over the last 13 years or so that we’ve been in business, we’ve grown

from a staff of three to a staff of 250 people. Into the next year I think we

are going to hire somewhere between 70 and 100 people.

It’s very possible to imagine that we are going to sustain

hiring almost 100 people over the next three to four years.

These [new]

people are going to come prepared to work the way we do, which is to

work with a high level of ambition, working tirelessly to make things work etc. That is certainly a big challenge.

Both of you were in a different field of knowledge before

you got into business. You were pharmacists I believe…

Ken:

[Laughing] I’m a dropout pharmacist and he’s a

graduate.

Bolaji: [Also laughing] He’s a dropout pharmacist and I’m a complete one.

When did you make the switch? What led to the ‘light-bulb moment’ occur for you on the subject of digital

commercial services?

Bolaji: Well,

how the practice works in Nigeria where education is free is that when you leave university you must do two year’s

national service to repay the government for your free education. I went to

public schools all my life and so I had to do a year’s internship where they

made sure that all I learned in university was still

in my head.

So for me in

particular, I worked in a the Swiss pharmaceuticals company Roche, did a tour

of government where I worked in a government hospitals and did a tour of

community pharmacies where I was the guy at the local community pharmacy.

I was still fresh from university but I knew a bit about life

by now and my conclusion was that being a pharmacist in Nigeria was the same as

being a teacher. Not that there’s anything wrong with being a teacher but when

you are a teacher your reward is in heaven and since

I was more of a commercial character…

Ken:

[Laughingly interjects] You wanted your reward on earth.

Bolaji:

[Laughing] Yes. I wanted to enjoy the rewards when I was still here. So I

decided to find something else to do with my life. It just so happened that Proctor and Gamble came to orientation

camp for the National Youth Service and on reading one of their flyers, I decided to

go and see what these guys were all about.

At Proctor

and Gamble, I met an Egyptian guy who told me that at the firm I would learn nothing in particular but instead a bit of

everything. But most importantly, he said, I would learn how to develop a

strong character and how to just find your way through life. I found those

statements intriguing and decided to try working

there and that’s when my life took a detour.

What about you Ken? What made you drop out of pharmacy?

Ken: I think the light bulb moment to get into technology

happened before I went to pharmacy school when I went to Strathmore University

where we were some of the pioneers of their computing

college.

So before I

went to pharmacy school I did some time at Strathmore and I fell in love with

computers. It’s just that simple.

Then when I

went to pharmacy school it became very clear that this typically was not my thing. I didn’t feel as much passion for it and so I

quit.

If you could go back to 2004, when you started your

business, knowing everything you know now about the business, what, if

anything, would you do differently?

Ken and

Bolaji: We’d never start it! [Laughter]

Ken: I know people like to give these nice political statements

to questions like this, saying things such as we’d do nothing differently because

the hard lessons were great lessons etc but looking back with hindsight, we’d

not start it.

Surely it

can’t be that bad, you’ve made a success out of this venture…

Ken and

Bolaji: It is that bad.

Ken: Don’t sugar-coat it. I know this is not the answer you

expected but man, we’d just not start it, but having said that the journey has

been unlike any other. Today I think as characters

and as individuals, we have been through just so much. There is nothing under

the sun that we haven’t seen.

Nevertheless,

generally when you look at it that way and see how far we’ve come, there’s no

other path — at least for me — that would

have yielded the same outcome. It has made me the person I am, the executive I

am.

Was

financial success your main goal or was it the innovation

that drove you?

Bolaji: The formation of this company had really nothing to do

with money. Because most people now might think we are in this to make a lot of

money.

We were just

intrigued by a problem in our society. By simply asking look, where are the companies in Africa started by regular people who

came from normal backgrounds? People who did not have rich fathers or uncles or

know political godfathers?

We wanted to

be a company started by regular people and today you can find regular people who will say, yes, I was there when these people started and

theirs is just a story of building it piece by piece.

Such stories

are few and far between but we said it is possible in Africa for regular people

to get a company going and grow it into a pan-Africa

business. I guess if we knew what we know now perhaps we might have found other

dreams, but that was our real motivation from the beginning.

We always

wanted to start businesses in many countries, even when those businesses were

not viable, but we felt it was and we have shown it

is possible to build a pan-African business.

What drives you? Cellulant is out there

and people are looking at it and wanting to emulate it. What advice would you

give them?

Ken: I think there needs to be a motivator other than money. Money is always as a result of the pursuit of

that motivation.

Bolaji: This question that you ask is very interesting because

there are guys

whose business model is to find their way to meetings like these, do you

understand what I mean? That is their business model,

they believe too much in networking.

But we’ve not

had that story. Like Ken said, it can’t only be money that drives people. I

think if I were to advise anyone I would tell them: You know what? You need to

find a human problem or a human need that only you

can solve. And then you need to see yourself as the person that can solve that

problem and not give up until that problem is solved. I think that’s how we

would summarise it. Because right from the word go, we wanted to build a company like this, but we’ve gone through different routes in

different markets to reach the ultimate end point that we sketched out many,

many years ago.

From the sound of it, you

guys are very focused and very driven, but in your down time what do you get up to? Do you even have down time?

Bolaji [laughing]: For me I don’t understand that concept at all.

Ken: We really enjoy what we do and so for me the concept of

relaxing or going on holiday or take time off work…I mean…Look at me now in

Cape Town at a conference. I feel like I’m on holiday

just enjoying what we do.

Bolaji: Like this trip to Cape Town now, is like a holiday for me.

I mean it is work, but it’s just like a holiday.

Ken: We like to work but of course we are also family men. So

in my case, my life is just a

dichotomy — I’m either at work or

with my family and that’s it. I don’t drink, I don’t go out, I don’t play golf

but I’ve taken to walking recently.

- See more at: http://www.the-star.co.ke/news/its-possible-regular-people-build-pan-africa-business#sthash.RzEKwaHd.dpuf

Source: http://www.the-star.co.ke/news/its-possible-regular-people-build-pan-africa-business

Posted by Ike Onwubuya

Tuesday 3 November 2015

MTN Group CEO Arrives Nigeria To Negotiate With FG On N1trn Fine

MTN Group CEO Arrives Nigeria To Negotiate With FG On N1trn Fine

MTN Group CEO Sifiso Dabengwa has arrived in Nigeria to negotiate with the Federal Government over the N1.04trn fine imposed on the telecom firm by the Nigerian Communications Commission (NCC) ) for violating its directive on SIM deactivation.

Dabengwa, who led a powerful team from South Africa, is currently in Abuja where he will be engaging Nigerian authorities concerning the company’s fine.

Dabengwa, who served as CEO of MTN Nigeria between 2004 and 2006, is expected to meet with the NCC Executive Vice Chairman, Umaru Garba Danbatta, National Security Adviser, Major-General Babagana Monguno (rtd.), and Chief of Staff to the President, Alhaji Abba Kyari, to negotiate a soft landing for the company.

“Any material developments in these engagements will be communicated to shareholders,” a statement from the company issued monday stated.

MTN has until November 16 to pay the fine, which relates to the timing of the disconnection of 5.1 million subscribers and is based on a charge of N200,000 for each unregistered customer not disconnected from its network.

Trading in MTN shares resumed yesterday on the Johannesburg Stock Exchange (JSE) after the telecoms firm issued a cautionary statement on its shares. JSE had temporarily suspended trading in MTN Group shares after the company’s stock tumbled last week following a $5.2bn fine by the Nigerian Communications Commission (NCC) for violating its directive on SIM deactivation.

JSE Director, Issuer Regulation, John Burke, had stated that “The JSE has halted all trading on MTN Group Limited. Trading will resume as soon as MTN Group Limited issued a SENS announcement.”

In a statement later, MTN Group Executive for Corporate Affairs, Chris Maroleng, said: “We take note of the JSE’s decision to suspend MTN’s shares.”

Trading in the shares later resumed after MTN issued the cautionary statement.

After declining by about 20 per cent last week, the company’s shares dipped further by about eight per cent monday.

Credit rating agencies Fitch and Moody’s have lowered MTN’s credit rating outlook to “negative” from “stable”, citing the regulatory fine. Standard & Poor’s also lowered the group to “BBB-” from “BBB” and placed it on credit watch with negative implications.

Nigeria is MTN’s biggest market with 62 million customers as of September. The stock has declined more than a fifth since news of the penalty was reported a week ago, and is trading at about three-year lows.

MTN could also face an investigation from the JSE to determine whether it, among other things, failed to inform the market timeously about its fine in Nigeria.

The fine was announced early last Monday but MTN informed shareholders only later that day, saying the fine was related to the “timing” of the disconnection of subscribers.

Under South African capital markets rules, companies are required to immediately warn shareholders of any materially price-sensitive information.

MTN is Africa’s largest mobile operator, with 233 million subscribers across the continent, with large market share in South Africa and Nigeria. It also has a large presence in the Middle East.

However, its stock began to tumble last week following a $5.2 billion (N1.04trn) fine by Nigerian regulators for not disconnecting up to five million unregistered SIM cards.

Giving reasons for the fine, NCC had said the commission had consistently engaged Mobile Network Operators, (MNOs) to strictly adhere to the regulations and its business rules in the registration of their subscribers. But despite all of these several engagements, the commission said it confirmed various cases of violations of the regulations and sanctioned appropriately.

“Given the recent security concerns in the country, government held several meetings with MNOs on the need to ensure only properly registered SIM cards are active on their networks,” NCC had said while announcing the fine slammed on the firm.

Source: DailyIndependent

Posted by Ike Onwubuya

Sunday 1 November 2015

Nigeria internet users increase to 97 million – NCC

The Nigerian Communications Commission, NCC, on Sunday, said the number of internet users on Nigeria’s telecoms networks has hit 97.21 million, up from the 95.37 million recorded in August.

The telecoms regulatory body made the disclosure in its Monthly Internet Subscriber Data for September, obtained by the News Agency of Nigeria.

The data revealed that internet users on both Global System for Mobile communications (GSM) and Code Division Multiple Access (CDMA) networks, increased by 1.84 million in September.

The data showed that of the 97.21 million internet users in September, 97.06 million were on GSM networks, while 151,816 users were on CDMA networks.

However, the CDMA operators lost 367 internet users, after recording 151,816 in September, against 152,183 in August.

MTN has 41.84 million subscribers browsing the internet on its network. NCC explained that MTN recorded an increase of 423,448 internet subscribers in September, after recording 41.41 million in August.

According to the data, Globacom has 21.89 million subscribers surfing the net on its network in September. About 20.77 million surfed the internet on the network in August.

Airtel had 17.73 million internet users in September as against 17.49 million customers recorded in August.

The data showed that internet users on the Airtel network increased by 235,941 in September.

NCC also said that Etisalat had 15.59 million customers who browsed the internet in September, against the 15.54 million users in August.

The data showed that those browsing the net on Etisalat’s network rose by 57,061 in the month of September.

The NCC data also revealed that the CDMA operators, Multi-Links and Visafone, had a joint total of 151,816 internet users on their networks in September.

It showed that the only two surviving CDMA networks in the country recorded a decrease of 367 internet subscribers in the month under review, from the 152,183 users they recorded in August.

According to the data, Visafone has a decrease of 393 customers surfing the internet in September, as it has 151,530, compared to the 151,923 users in the month of August.

Multi-Links had 286 internet users in September, adding 26 customers from the August record of 260 users.

The increase in the use of the internet in the month of September showed that more Nigerians were embracing data as the country moves towards achieving 30 per cent broadband penetration by 2018. (NAN)telecoms networks has hit 97.21 million, up from the 95.37 million recorded in August.

The telecoms regulatory body made the disclosure in its Monthly Internet Subscriber Data for September, obtained by the News Agency of Nigeria.

The data revealed that internet users on both Global System for Mobile communications (GSM) and Code Division Multiple Access (CDMA) networks, increased by 1.84 million in September.

The data showed that of the 97.21 million internet users in September, 97.06 million were on GSM networks, while 151,816 users were on CDMA networks.

However, the CDMA operators lost 367 internet users, after recording 151,816 in September, against 152,183 in August.

MTN has 41.84 million subscribers browsing the internet on its network. NCC explained that MTN recorded an increase of 423,448 internet subscribers in September, after recording 41.41 million in August.

According to the data, Globacom has 21.89 million subscribers surfing the net on its network in September. About 20.77 million surfed the internet on the network in August.

Airtel had 17.73 million internet users in September as against 17.49 million customers recorded in August.

The data showed that internet users on the Airtel network increased by 235,941 in September.

NCC also said that Etisalat had 15.59 million customers who browsed the internet in September, against the 15.54 million users in August.

The data showed that those browsing the net on Etisalat’s network rose by 57,061 in the month of September.

The NCC data also revealed that the CDMA operators, Multi-Links and Visafone, had a joint total of 151,816 internet users on their networks in September.

It showed that the only two surviving CDMA networks in the country recorded a decrease of 367 internet subscribers in the month under review, from the 152,183 users they recorded in August.

According to the data, Visafone has a decrease of 393 customers surfing the internet in September, as it has 151,530, compared to the 151,923 users in the month of August.

Multi-Links had 286 internet users in September, adding 26 customers from the August record of 260 users.

The increase in the use of the internet in the month of September showed that more Nigerians were embracing data as the country moves towards achieving 30 per cent broadband penetration by 2018. (NAN)

Wednesday 28 October 2015

UNICORN: Can A Startup From Nigeria Grow To $100 Billion?

UNICORN: Can A Startup From Nigeria Grow To $100 Billion?

The spark for this post came from a discussion on Radar.

Despite the dominance of US, the rest of the world also produces their unicorns with global or regional relevance. For example, AliBaba came out of China; MyTeksi a Malaysian car hailing startup is spreading across Europe, while WeChat is a big contender in chat app space, worth $50billion in valuation. Everybody knew Nokia and Blackberry in their hey-days when they ruled the world as top mobile devices. One is from Finland and the other Canada; same with Samsung and Xiaomi which are not from US, but Korea and China respectively.

So, which startup will rule out of Nigeria (Africa) and be the Unicorn….and how?

I wish this could happen soon to fulfill a personal wish, which I revealed at the concluding part of this post. But why are we not having run-away successful Nigerian-founded startups yet?

A short answer:

A lot have to do with our ecosystem. And we owe it to ourselves to change this or we are doomed.

A longer answer:

1. We are “lazy”.

Look around. You will notice that we have done little or nothing to articulate solutions to our own local problems. Take for example that VConnect, LostInLagos, Jumia, HelloTractor, OLX, JiJi, PulseNG and the list goes…. are ‘foreign” that have done better to articulate our Nigerian problems and invested better in them than us. This in itself is not bad, but we need to have more African founders solving these problems with the same vigour or more.

Don’t get me wrong, we are trying, just that many of us are barely scratching the ground with our initiatives.

2. Labour is ‘dirt’ cheap and our founders (and their investors) take it all

There is truth in the saying that “he who pays the most for the talent grabs it”, that might explain why our best talents are grabbed and recruited by foreign startups to head their local operations. Take for example, the amiable Lola Masha (OLX) and Ebi Atawodi of UBER.

It is needful to say this because I know labour is cheap and staff salary are super low here so people are eager to take their skills around to the highest bidder because there is a low cost of transfer to them (the employee) but a big risk to employers.

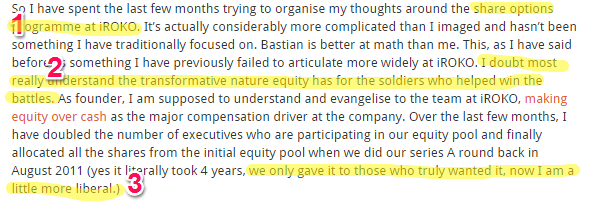

Our local startups should set high standards to attract and retain world-class talents like Microsoft, Facebook and Google who have produced millionaire employees. Some startups seem to be getting the message as articulated by Jason on his blog, where he discussed granting equity to his executives.

I instantly became impressed. J

More startups in Nigeria should do this and be willing to give their employee equity to get long term commitments. It is called employee stock ownership plan (ESOP).

More startups in Nigeria should do this and be willing to give their employee equity to get long term commitments. It is called employee stock ownership plan (ESOP).

3. We don’t raise enough money to scale.

Recently, Paga completed a round of funding. While this might look an easy feat to accomplish, it is not the norm for most startups.

Largely, the local funding climate in Nigeria is a Sahara desert as the typical Nigerian investor will rather invest in real estate or when he chooses to invest ask for too much in equity. But there is glimmer of hope that platforms like Lagos Angel Network and African Business Angel Network will provide necessary enlightenment to the Investor community about the massive potentials in Startups.

To drive home my point, look at the Funders’ sheet of IrokoTV, Wakanow, Paga and Jobberman (already acquired by OAM), to see who actually invested in their startups to validate them. Many times, the investor with the deep pocket is in The West.

So if the money is in The West, what matters is not actually kicking out the foreigners but making majority of the money stay in Nigeria through Nigeria founders and executives.

Like;

Having more of Tunde Kehinde (ACE Courier), Iyin Aboyeji (Andella), Simeon Onobi (SimplePay) and others; who through their strategic partnerships are wooing investors to bring their money to play in the Nigeria startups ecosystem. And this is not strange, even the legendary Jack Ma who raised one of the highest IPOs ever that valued Alibaba at $225billion did it in US…..to serve a market in China.

While on the issue:

Founders’ should not mistake investors’ money as free cash. Raising funds is a relationship. As *Tomi Davies puts it: “It is about the chemistry with the investor…..”

*Note: Tomi Davies has developed a useful framework to getting funded that is worth checking out.

4. Let’s play AFRICA

Rather than create a clone of a “Silicon Valley” in “Yaba”, we should redefine our game plan by looking inwards to solve Nigerian problems with international expertise.

Wait.

Africa has a population of over 1 billion people and we have challenges that are peculiar to us. So charity should begin at home. Jack Ma, CEO of Alibaba, is famous for his quote about being the crocodile in Yangtze River and fighting to win on his own turf

In Africa, we have a (potentially) billion problems waiting to be solved. For example:

- MallForAfrica is strategically positioned to solve a nagging Nigeria/African problem of buying stuffs from the US and shipping them home. This is an African problem

- JobberMan redefined the Nigerian job market for verifiable jobs and became the biggest jobs site in Africa before being acquired.

- IrokoTV is taking massive advantage of the NollyWood industry globally.

- VoguePay is solving the pain of online payment for SMEs and developers. I know firsthand about their expansive homegrown technology that solves complex developer challenges and makes payment easy at the cost of FREE integration for SMEs

5. Let’s Huddle……Together.

The truth is that no one is going to grow our ecosystem for us, better than we can do by ourselves. Not even Google. We have to maintain concerted efforts to promote entrepreneurship. Kudos to Tony Elumelu’s TEEP, CCHub, Andella, other several incubation hubs and coding academies that are strategic to the overall future development of Nigeria startups.

Another key part is organizing events focused around the entire ecosystem like ABAN, LAN (for investor community), Mobile Monday and StartUpGrind (focused on founders and developer community) to fire up the ecosystem.

This is also not a time everyone wants to be the “CEO of something” at all cost when you can wait like the PayPal mafias to be thoroughly incubated to execute future startups.

6. So, in all this, where does the Government come in?

To encourage investments in this sector, we can push for legislation, similar to what is obtainable in Europe where high net worth individuals who invest in local startups (and keep their investments up to three years) can benefit from tax rebate up to 50%. In Turkey, it is reported to be as high as 100%

Other options to experiment with can include:

- Technology concessions programs like Aliko Dangote got for virtually all level of trading and businesses.

- Free Trade Zone-esquemodel for Technology firms i.e. pay ZERO tax and “repatriate” all profit

- Financial grant like the Nollywood industry enjoyed under previous Federal administration

To get any of these, we can start lobbying our Government.

The rest of the world does this too. Facebook, Uber and the rest have executive hires that are political lobbyists whose roles are to buy government to their sides and direct the course of policies. We have great guys in the space like Tolu Ogunlesi, Gbenga Sesan, Jude Chunwo, Japhet Omojuwa who I presume are close to the government of the day with their *involvements* in the last elections.

I hope any of them can lend a hand to this cause.

7. Conclusion: Why Do I care?

In one part I share a similar concern raised in this post about not allowing foreign multinationals to “invade” the opportunities we still have to build a global, proudly Nigerian startup ecosystem; just like we “lost” our oil and gas sector.

And in the other part, I want one of my kids to work in (or start) a Nigeria-owned startup worth $10 to $100 billion….and that is less than 20 years away from now.

I think if this does not happen, Nigeria and Africa could be a deserted Continent.

Wole Ogunlade is a digital marketing expert; he is the editor of SpokenTwice.com, a blog dedicated to teaching marketing topics covering conversion optimization, growth hacking and marketing automation strategies. You can connect with him on linkedin. Or twitter @spokentwice.

Photo Credit: MBK (Marjie) via Compfight cc

Culled by Ike Onwubuya

Sunday 25 October 2015

Oando records N179b loss in 2014

The News Agency of Nigeria reports that this is against the backdrop of a profit after tax of N4.68 billion posted in 2013.

This was contained in a statement released by the company in Lagos, a copy of which was obtained by NAN.

It said the company recorded a turnover of N424.68 billion compared to N449.87 billion recorded in the corresponding period, 2013.

The statement added the company for the six month ended on June 30 declared revenue of N60.32 billion against N55.67 billion posted in the comparative period in 2014.

According to the statement, the loss after tax stands at N34.68 billion in contrast with the profit after tax of N5.74 billion achieved in 2014.

The statement quoted Wale Tinubu, the Group Chief Executive Officer, as saying that the company would bounce back into profitability in 2016.

It said the company’s profit after tax numbers were impacted by impairments of N76.9 billion in exploration and production, N16.9 billion in under lift and N7.3 billion foreign exchange losses, among others.

The statement said appropriate consolidation of Oando’s subsidiaries’ accounts and painstaking due diligence undertaken as a result of the magnitude of impairments contributed to the delay in the release of its accounts.

It said: “Upstream players have been forced to record significant reductions in the fair value of their asset portfolios.

“Oando is no exception to this global trend, which has led us to recognise about N76.9 billion of impairment charges in our exploration and production business.”

The statement also said the impairment was due to lower oil prices leading to a reduced valuation of certain exploration and appraisal assets.

It said: “The nature of the business makes us extremely vulnerable to foreign exchange risks as we import in dollar denomination and recover our costs in naira.

“The delay of payments of subsidies from the Federal Government has served to increase this vulnerability and led to a realisation of N7.3 billion in foreign exchange losses.”

NAN.

Culled by Ike Onwubuya

Source - http://theeagleonline.com.ng/oando-records-n179b-loss-in-2014/

Latest News

-

Nigeria: Nmdpra, Major Marketers to Track Products' Movement - [Daily Trust] The Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA) has said it is partnering with major oil marketers to put some ...11 hours ago

-

Reimagining Zambia’s restructuring in an alternative New York dimension - Would the proposed legislation even help?23 hours ago

-

Naira appreciates to N1,220/$ in parallel market - The naira yesterday appreciated to N1, 220 per dollar in the parallel market from N1, 238 per dollar on Wednesday. The post Naira appreciates to N1,220/$...4 months ago

-

Sh2m fine for fake used vehicle mileage records - Bill updates the 1979 law to protect consumers from false trade practices, including fake online goods.3 years ago

-

Leapfrogging the power grid - African power grids are failing to provide the continent’s population with access to electricity. Innovative private companies are taking matters into th...6 years ago

-

Africa-China textile tensions - Tensions have erupted between China and Africa over the price of Chinese textiles.11 years ago

Stock Markets News

-

Kenya: Kenya Urged to Unleash the Power of Financial Markets - [Capital FM] Nairobi -- More listings and liquidity are signs that Kenya's financial market is starting to grow. But local traders and individual investors...1 day ago

-