UNICORN: Can A Startup From Nigeria Grow To $100 Billion?

The spark for this post came from a discussion on Radar.

Despite the dominance of US, the rest of the world also produces their unicorns with global or regional relevance. For example, AliBaba came out of China; MyTeksi a Malaysian car hailing startup is spreading across Europe, while WeChat is a big contender in chat app space, worth $50billion in valuation. Everybody knew Nokia and Blackberry in their hey-days when they ruled the world as top mobile devices. One is from Finland and the other Canada; same with Samsung and Xiaomi which are not from US, but Korea and China respectively.

So, which startup will rule out of Nigeria (Africa) and be the Unicorn….and how?

I wish this could happen soon to fulfill a personal wish, which I revealed at the concluding part of this post. But why are we not having run-away successful Nigerian-founded startups yet?

A short answer:

A lot have to do with our ecosystem. And we owe it to ourselves to change this or we are doomed.

A longer answer:

1. We are “lazy”.

Look around. You will notice that we have done little or nothing to articulate solutions to our own local problems. Take for example that VConnect, LostInLagos, Jumia, HelloTractor, OLX, JiJi, PulseNG and the list goes…. are ‘foreign” that have done better to articulate our Nigerian problems and invested better in them than us. This in itself is not bad, but we need to have more African founders solving these problems with the same vigour or more.

Don’t get me wrong, we are trying, just that many of us are barely scratching the ground with our initiatives.

2. Labour is ‘dirt’ cheap and our founders (and their investors) take it all

There is truth in the saying that “he who pays the most for the talent grabs it”, that might explain why our best talents are grabbed and recruited by foreign startups to head their local operations. Take for example, the amiable Lola Masha (OLX) and Ebi Atawodi of UBER.

It is needful to say this because I know labour is cheap and staff salary are super low here so people are eager to take their skills around to the highest bidder because there is a low cost of transfer to them (the employee) but a big risk to employers.

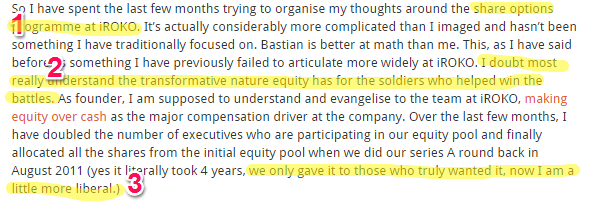

Our local startups should set high standards to attract and retain world-class talents like Microsoft, Facebook and Google who have produced millionaire employees. Some startups seem to be getting the message as articulated by Jason on his blog, where he discussed granting equity to his executives.

I instantly became impressed. J

More startups in Nigeria should do this and be willing to give their employee equity to get long term commitments. It is called employee stock ownership plan (ESOP).

More startups in Nigeria should do this and be willing to give their employee equity to get long term commitments. It is called employee stock ownership plan (ESOP).

3. We don’t raise enough money to scale.

Recently, Paga completed a round of funding. While this might look an easy feat to accomplish, it is not the norm for most startups.

Largely, the local funding climate in Nigeria is a Sahara desert as the typical Nigerian investor will rather invest in real estate or when he chooses to invest ask for too much in equity. But there is glimmer of hope that platforms like Lagos Angel Network and African Business Angel Network will provide necessary enlightenment to the Investor community about the massive potentials in Startups.

To drive home my point, look at the Funders’ sheet of IrokoTV, Wakanow, Paga and Jobberman (already acquired by OAM), to see who actually invested in their startups to validate them. Many times, the investor with the deep pocket is in The West.

So if the money is in The West, what matters is not actually kicking out the foreigners but making majority of the money stay in Nigeria through Nigeria founders and executives.

Like;

Having more of Tunde Kehinde (ACE Courier), Iyin Aboyeji (Andella), Simeon Onobi (SimplePay) and others; who through their strategic partnerships are wooing investors to bring their money to play in the Nigeria startups ecosystem. And this is not strange, even the legendary Jack Ma who raised one of the highest IPOs ever that valued Alibaba at $225billion did it in US…..to serve a market in China.

While on the issue:

Founders’ should not mistake investors’ money as free cash. Raising funds is a relationship. As *Tomi Davies puts it: “It is about the chemistry with the investor…..”

*Note: Tomi Davies has developed a useful framework to getting funded that is worth checking out.

4. Let’s play AFRICA

Rather than create a clone of a “Silicon Valley” in “Yaba”, we should redefine our game plan by looking inwards to solve Nigerian problems with international expertise.

Wait.

Africa has a population of over 1 billion people and we have challenges that are peculiar to us. So charity should begin at home. Jack Ma, CEO of Alibaba, is famous for his quote about being the crocodile in Yangtze River and fighting to win on his own turf

In Africa, we have a (potentially) billion problems waiting to be solved. For example:

- MallForAfrica is strategically positioned to solve a nagging Nigeria/African problem of buying stuffs from the US and shipping them home. This is an African problem

- JobberMan redefined the Nigerian job market for verifiable jobs and became the biggest jobs site in Africa before being acquired.

- IrokoTV is taking massive advantage of the NollyWood industry globally.

- VoguePay is solving the pain of online payment for SMEs and developers. I know firsthand about their expansive homegrown technology that solves complex developer challenges and makes payment easy at the cost of FREE integration for SMEs

5. Let’s Huddle……Together.

The truth is that no one is going to grow our ecosystem for us, better than we can do by ourselves. Not even Google. We have to maintain concerted efforts to promote entrepreneurship. Kudos to Tony Elumelu’s TEEP, CCHub, Andella, other several incubation hubs and coding academies that are strategic to the overall future development of Nigeria startups.

Another key part is organizing events focused around the entire ecosystem like ABAN, LAN (for investor community), Mobile Monday and StartUpGrind (focused on founders and developer community) to fire up the ecosystem.

This is also not a time everyone wants to be the “CEO of something” at all cost when you can wait like the PayPal mafias to be thoroughly incubated to execute future startups.

6. So, in all this, where does the Government come in?

To encourage investments in this sector, we can push for legislation, similar to what is obtainable in Europe where high net worth individuals who invest in local startups (and keep their investments up to three years) can benefit from tax rebate up to 50%. In Turkey, it is reported to be as high as 100%

Other options to experiment with can include:

- Technology concessions programs like Aliko Dangote got for virtually all level of trading and businesses.

- Free Trade Zone-esquemodel for Technology firms i.e. pay ZERO tax and “repatriate” all profit

- Financial grant like the Nollywood industry enjoyed under previous Federal administration

To get any of these, we can start lobbying our Government.

The rest of the world does this too. Facebook, Uber and the rest have executive hires that are political lobbyists whose roles are to buy government to their sides and direct the course of policies. We have great guys in the space like Tolu Ogunlesi, Gbenga Sesan, Jude Chunwo, Japhet Omojuwa who I presume are close to the government of the day with their *involvements* in the last elections.

I hope any of them can lend a hand to this cause.

7. Conclusion: Why Do I care?

In one part I share a similar concern raised in this post about not allowing foreign multinationals to “invade” the opportunities we still have to build a global, proudly Nigerian startup ecosystem; just like we “lost” our oil and gas sector.

And in the other part, I want one of my kids to work in (or start) a Nigeria-owned startup worth $10 to $100 billion….and that is less than 20 years away from now.

I think if this does not happen, Nigeria and Africa could be a deserted Continent.

Wole Ogunlade is a digital marketing expert; he is the editor of SpokenTwice.com, a blog dedicated to teaching marketing topics covering conversion optimization, growth hacking and marketing automation strategies. You can connect with him on linkedin. Or twitter @spokentwice.

Photo Credit: MBK (Marjie) via Compfight cc

Culled by Ike Onwubuya